COCOA MARKET

Lower demand sees Brazil’s cocoa grinding drop 15%

A worker walks across cocoa beans laid out to dry in a barge on a cocoa farm along Bahia’s Cacao Coast in southern Brazil. Photo: Caio Pederneiras/Shutterstock

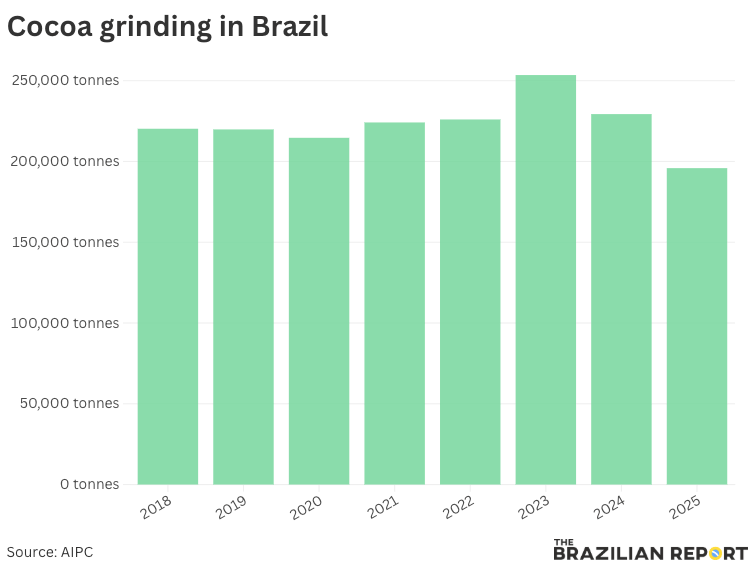

Brazil experienced a sharp decline in cocoa grinding in 2025, capping a difficult year for a sector that is still trying to rebuild after decades of setbacks.

The industry processed 195,882 tonnes of cocoa last year, a drop of nearly 15% from 2024 and well below the annual average of 230,000 tonnes recorded between 2020 and 2025. The figures come from industry association AIPC, which represents Brazil’s largest cocoa grinders, who together account for roughly 90% of national output.

The decline was largely driven by weaker demand, with sales of cocoa derivatives used in the chocolate and food industries fell 18% over the year.

At the same time, Brazilian cocoa production — measured by the volume of beans received by AIPC members for grinding — rose 4% to 186,137 tons. Even so, domestic output again failed to meet local demand, which was supplemented by imports.

The results underscore the broader challenges facing Brazil and the global cocoa trade. Worldwide production has…

🔒 This was a free preview; the rest is behind our paywall

Don’t miss out! Upgrade to unlock full access. The process takes only seconds with Apple Pay or Stripe. Become a member.

Why you should subscribe

We’re here for readers who want to truly understand Brazil and Latin America — a region too often ignored or misrepresented by the international media.

Since 2017, our reporting has been powered by paid subscribers. They’re the reason we can keep a full-time team of journalists across Brazil and Argentina, delivering sharp, independent coverage every day.

If you value our work, subscribing is the best way to keep it going — and growing.

Interested in advertising with us? Get in touch.

Need a special report? We can do it.

Have an idea for an article or column? Pitch us